Report: Xiaomi beats Apple to become world’s third biggest smartphone firm

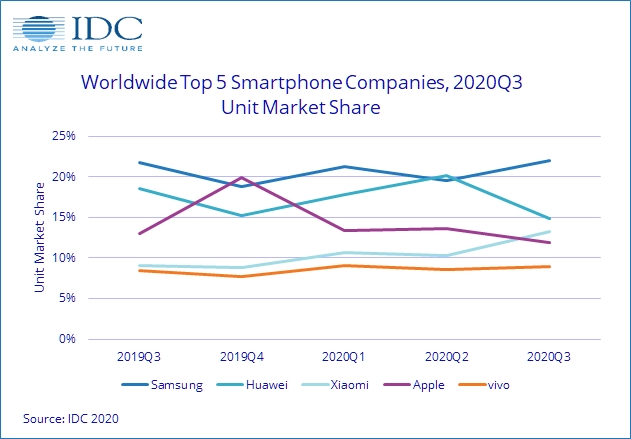

- According to global research firms, Samsung retook the biggest smartphone OEM title from Huawei in Q3 2020.

- Xiaomi, with a record quarter, overtook Apple as the world’s third-biggest smartphone maker.

- Global smartphone shipments also returned to near-2019 levels, as the industry recovery continues.

On the back of the good news from India, it seems the global smartphone market is showing signs of recovery too. According to research from IDC, global smartphone shipments topped 353 million in Q3 2020, just shy of the levels recorded a year prior. But some OEMs recovered more than others.

It was a positive quarter for Samsung. Although it grew by just 2.9% year-over-year, this was enough to retake the smartphone market lead from Huawei. The Korean firm shipped 80.4 million units for a 22.7% market share. This time, its position isn’t disputed either. Both Canalys and Counterpoint recorded Samsung as the top smartphone maker in Q3 2020 as Huawei’s decline continues.

The Chinese firm’s struggles in the west are compounded by dropped shipments in its home country. Once a stronghold for Huawei, the firm saw a decline in Chinese shipments of 15%, according to IDC. Canalys data also suggests that Huawei’s shipments fell by 25% year-over-year in Europe.

Xiaomi’s meteoric rise continues

While Huawei still claims second place worldwide, Xiaomi is threatening to topple it. Again.

Xiaomi saw year-over-year growth of 42% per IDC data, eclipsing Apple’s shipments for the first time, and claiming a 13.1% global market share. That record growth is especially notable considering it shipped around two million more units than fifth-placed Vivo before the pandemic. This growth was buoyed by production capacity recovery in India, mirroring the firm’s performance in that country, too.

The late iPhone 12 series launch didn’t help Apple in Q3 2020. Per IDC, the now fourth-placed firm shipped five million fewer units year-over-year, an annual drop of nearly 11%. Both Counterpoint and IDC expect the firm to recover once its new flagship sales roll in.

The BBK battle heats up

Finally, the best of the rest largely consists of BBK brands.

Vivo saw a minor increase in smartphone shipments year-over-year but holds onto its fifth place globally, per IDC data. Counterpoint disputes this though, placing Oppo in fifth place. Either way, it suggests the firms are separated by a 1% sliver of market share.

Realme reportedly had a bumper Q3 2020. Counterpoint suggests the firm saw the strongest growth among OEMs globally, with a 132% increase in quarter-over-quarter shipments. The research firm places it in seventh place globally. OnePlus saw quarterly growth of 96% buoyed by its performance in India and Western Europe.

Next: The best Android phones you can buy

from Android Authority https://ift.tt/3876nMT

Post a Comment